Although it has been around for quite some time, there are still many people who have never heard of Amazon MCF (Multichannel Fulfillment) and the remarkable benefits it offers to sellers.

The business of FBA

Amazon is renowned as an asset-heavy business. In addition to its well-known storefront at amazon.com, which generates hundreds of billions of dollars in sales (Amazon, 2022), Amazon's most significant asset is its extensive network of warehouses and delivery fleet.

This post-checkout infrastructure is known as Amazon FBA (Fulfillment by Amazon). For most of us, it is the primary reason why we have remained loyal to Amazon for so long. While the shopping experience on Amazon may not be the best in the industry, the buying experience is unparalleled.

Customer satisfaction is a key factor that makes Amazon so appealing. Any item purchased through FBA is delivered quickly and securely. FBA has become the gold standard in e-commerce delivery. However, this has also posed challenges for Amazon.

Amazon FBA is an enormous cost center, with top-notch automation, robots, conveyor belts, thousands of employees, and the expenses associated with running warehouses. Although revenue is generated through the storefront, FBA represents a substantial expense on the profit and loss statement. Optimizing FBA efficiency is a major undertaking for the tech giant. If FBA were to suddenly cease or if sellers massively migrated to FBM (Fulfilled by Merchant), the cost of running an e-commerce business for Amazon would be insurmountable.

The Hidden Side of FBA

There is a good reason why FBA listings rank higher. The more FBA sellers sell → the more dynamic the warehouses become → the greater the economies of scale → resulting in an improved buying experience. This generates word-of-mouth referrals and attracts new sellers to FBA.

While this is a clear win-win for Amazon, let's take a moment to consider the implications for customers.

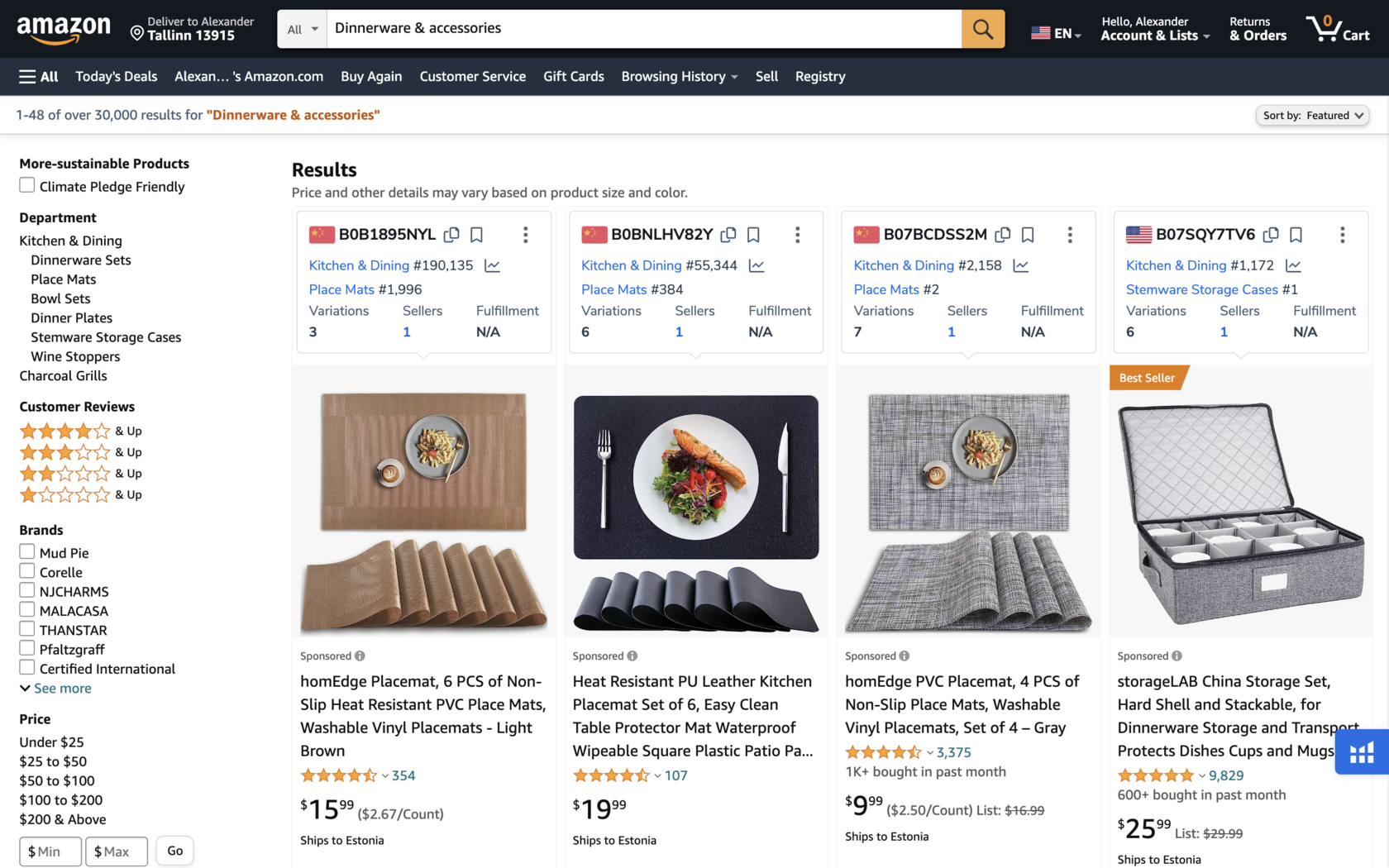

When a customer shops on Amazon and selects a category, they are presented with only 48 listings.

If there are a total of 96 listings in that category, the chances of seeing all of them are quite high. However, when there are 30,000 listings, the chances of seeing most of them are quite slim.

As a customer, only the first several pages of listings matter the most. The rest are largely irrelevant, as it is unlikely that one would have the time or desire to sift through 30,000 different chopping boards in a category, for example.

It is important to remember that Amazon does everything possible to maximize conversions. If the increasing number of listings in a category negatively affects conversions, Amazon introduces new sub-categories (nodes) to cluster products into more manageable groups. Imagine how many sub-categories have emerged over the past 10 years (link)?

Over time, the sheer volume of products has become so massive that breaking them into sub-categories has started yielding diminishing returns for Amazon.

There are two primary reasons for this:

- While new products and sub-categories can be continuously added, and new warehouses allocated for FBA, human beings are physically incapable of processing billions of products at once.

- New sellers who engage in Amazon FBA often realize that Amazon is not as lucrative as it may seem. Sales may stagnate, stock becomes locked, and morale hits rock bottom. What does Amazon do?

That's right, sellers need advertisements to get the sales flywheel spinning. Since the launch of Amazon Ads in 2012, it has become one of the fastest-growing businesses within the Amazon family. Brands and retailers spent 37.7 billion dollars on ads in 2022 (Amazon, 2022). Has this changed the status quo? Well...

Here Comes the Revolution

Although generating substantial income for the tech giant, Amazon Ads has become one of the most controversial additions to the ecosystem.

Some argue that ads are used by Amazon to manipulate search results for profitable sellers and make them spend more on ads. Others claim that ads help mitigate issues with the A9 search algorithm (re: below).

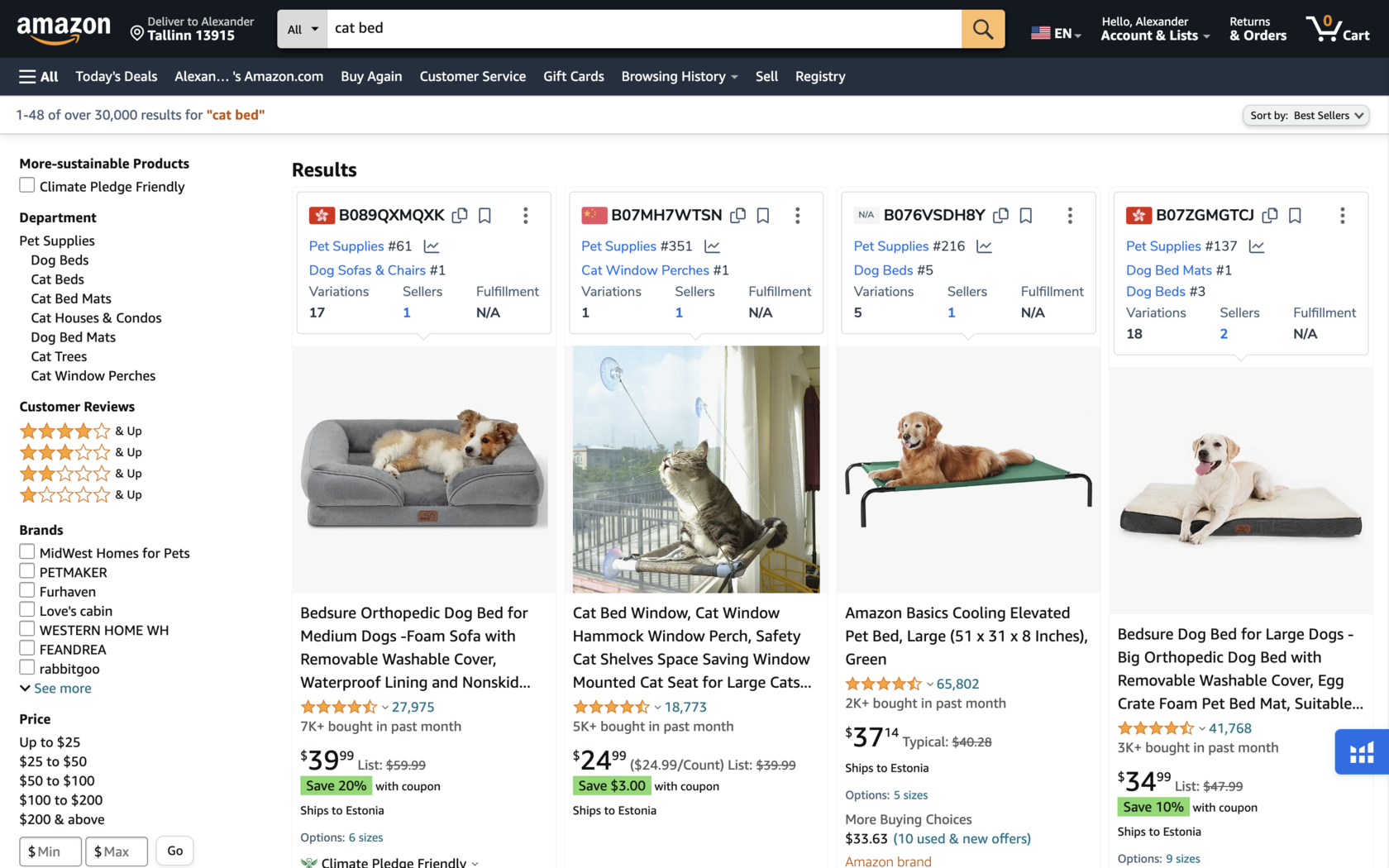

Searched for a cat bed? Search again...

Some even view ads as a purely profit-driven endeavor by Amazon's executive team. What remains clear is that, along with the LTR in A9, ads have helped reshuffle search results for new sellers and optimize them for cold searches.

Has this resulted in driving more customer traffic to the storefront? Not really.

While Amazon happily secures an additional source of income for the profit and loss statement through ads, it had to go back to the drawing board to figure out ways to unlock stock at warehouses and accelerate the scaling of FBA. The solution was quite straightforward: if FBA is a cost center that is fueled by new orders, why not generate new orders from everywhere?..

Let's take a step back and analyze this: massive amounts of inventory have been purchased, imported, cleared, labeled, and allocated at FBA warehouses, all prepared for fulfillment and delivery within 24 hours (not 60 days like on Aliexpress). The only missing piece is the order that triggers the release of stock and sets the FBA flywheel in motion.

Damn, if orders are the bottleneck, let's get as many orders as possible! Let's develop a feature that can generate orders for off-Amazon sales, deploy it in SP-API (Selling Partner API), and connect it to as many external storefronts as we can. Walmart, eBay, BestBuy, Allegro, Shopify, WooCommerce, TikTok – sell wherever you want and deliver with FBA.

And so it began...

"Buy Local"

New use cases emerged almost immediately.

- Brands and retailers on FBA realized that instead of investing in expensive Amazon Ads, they could engage their loyal customers on platforms like Shopify, Instagram, TikTok, and WhatsApp, and fulfill orders directly from FBA warehouses using Prime shipping.

- Drop-shippers realized that instead of shipping from China, they could leverage local inventory and improve delivery times by utilizing FBA.

- Influencers and opinion leaders gained access to massive on-hand inventory ready for immediate shipping – all they needed to do was connect it to their storefront.

- Entrepreneurs discovered that instead of searching for new private label products on Alibaba, they could find a niche right on Amazon and build a brand story while delivering the ultimate customer experience with goods delivered within 24 hours.

And these are just a few examples...

Amazon MCF has already brought significant changes, and it will continue to evolve as we embrace its new functionalities.

Have you heard of MCF, and are you currently utilizing it? We would love to hear about your experiences.